IRAs Are a Charitable Idea

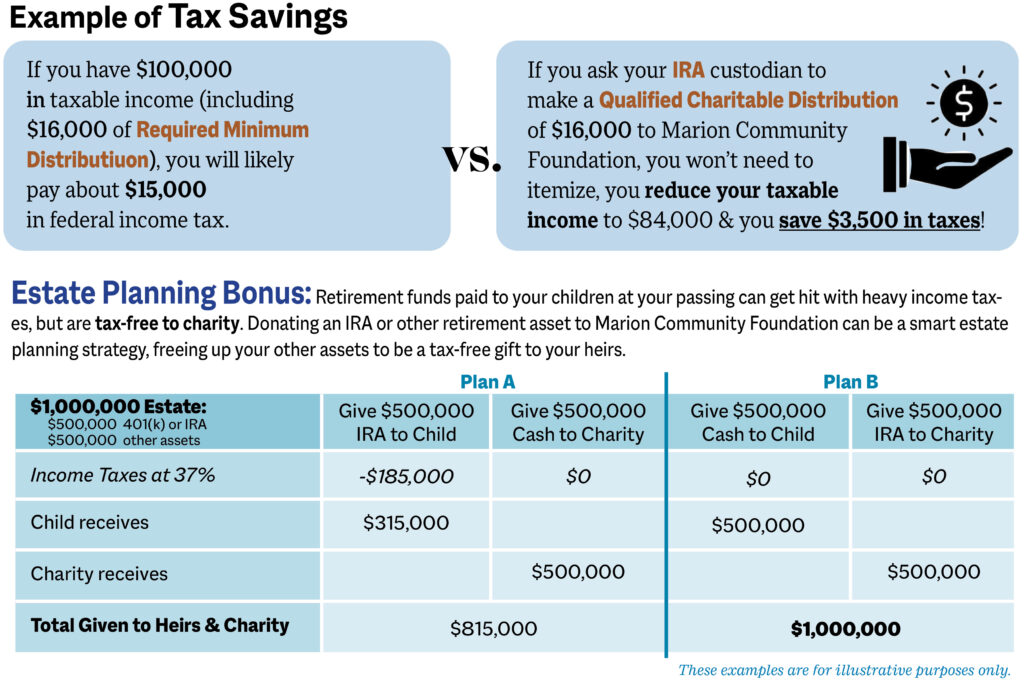

Here’s a special tax benefit you don’t want to miss! When you’re required to begin taking distributions from your IRA—somewhere in your early 70s, depending on what year you were born—if it is a traditional IRA, you are required to pay income taxes on the proceeds. But, if you gift the distribution directly to a charity, like Marion Community Foundation, you won’t have to pay any taxes on that income—a savings of up to 37 percent!

Instead of just writing a check this year for your charitable donation to Marion Community Foundation, simply direct your IRA RMD to the Foundation and you’ll be money ahead.

Qualified charitable distributions, or QCDs, allow donors who are at least 70-1/2 years old to give charities up to $100,000 a year directly from their IRAs without it counting as taxable income. You don’t need to itemize your deductions to take advantage of this charitable benefit. And, QCDs count toward your required minimum distribution—the amount of money you must withdraw from your IRA annually. You don’t include QCD gifts as an itemized deduction on your federal tax return; instead, the QCD is a dollar-for-dollar reduction against income, whether you itemize or not. That’s a win-win!

IRA distributions can’t go to donor advised funds or life-income gifts, such as charitable remainder trusts or gift annuities, but every other type of fund at Marion Community Foundation is allowable. The distribution must go directly to Marion Community Foundation, not through your hands first. Your IRA custodian can provide you with the proper QCD form to make this distribution to Marion Community Foundation.

State laws about charitable deductions and QCDs vary. Consult your legal or tax advisor.

Investment Confidence

Expertise & Trust

Jeff Touched So Many Hearts

New Funds: Adler, Dixon, President’s Band Club

3 Reasons to Give Away Appreciated Stock

Generosity in Many Forms

Giving in Circles

Want to Stop Writing Checks?

A Passion for Animals

2024-25 Board of Directors: Members & Officers