Creating a lasting legacy is easier than you think. At Marion Community Foundation, we’re here to help you establish a charitable fund that reflects your values and supports the causes you care about—today and for generations to come.

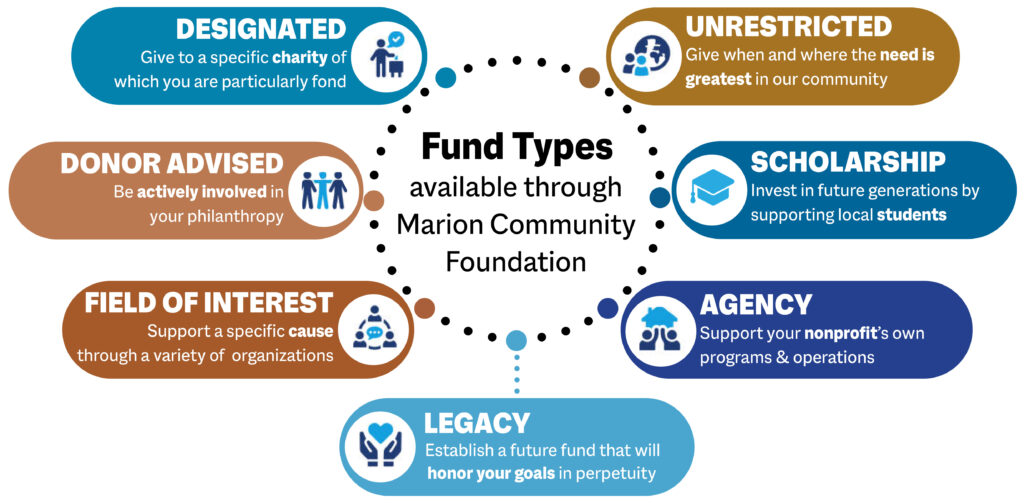

Fund Types to Meet Your Goals

How to Get Started

Together, we will:

- Clarify your charitable intent and identify your giving goals.

- Explore the types of funds available and help you choose the best fit. (More on that below.)

- Prepare the governing documents to formalize your intentions.

- Help you name your fund—after yourself, a loved one, a cause, or anonymously.

- Identify fund advisors and successors, if applicable.

- Accept your initial contribution—using cash, stock, retirement assets, or other options.

- Provide ongoing support & updates.

Once your fund is established, you can:

- Add to it at any time, in any amount.

- Recommend how grants are recognized: in your name or anonymously.

- Suggest grants to the nonprofits you care about (if your fund allows).

If you have questions or need assistance at any point, we’re here to help.

What Kind of Fund Should I Start?

Your fund should reflect how you want to give. Here are the main types we offer:

Support a

favorite charity

James C. Cooper started a fund with just $100 for his beloved St. Mary Church. At his passing, the proceeds of his IRA were added to the fund. It now gives $2,000+ annually in his name and will continue to do so forever.

Designated Fund

If you have a special place in your heart for a particular nonprofit, a designated fund ensures they receive ongoing annual support. This is a great option for longtime volunteers, board members, or anyone deeply connected to a cause.

Support a cause

you care about

Makes grants in support of the arts – specifically live theater and dance – that Kathy so dearly loved.

Field of Interest Fund

Want to support an entire cause—like the arts, education, or healthcare? A field of interest fund focuses your giving while allowing flexibility to support the best local organizations doing that work.

Stay involved

in your giving

The James & Margaret Coulson Fund allows their niece, Suzie Brown, to honor their memory through thoughtful annual giving.

Donor Advised Fund

Donor advised funds are perfect for those who want to remain hands-on with their philanthropy. Recommend grants to various charities over time—it’s flexible, simple, and impactful.

Let us decide

where it’s

needed most

The Roberts Fund, created by the children of Chester & Mildred Roberts, supports evolving community needs each year.

Unrestricted Fund

If you want to make a difference but aren’t tied to a specific cause, an unrestricted fund allows our expert Board of Directors to direct your gift to the most pressing community needs as they arise.

Support students through education

The John T. Gordon Memorial Eagle Scout Scholarship helps Scouts further their education in his honor.

Scholarship Fund

Help local students pursue their dreams with a scholarship fund. You choose the eligibility criteria—field of study, financial need, alma mater, or other factors.

Build your

nonprofit’s

future

The Emanuel Lutheran Church Fund, created by Don and Betty Jerew, benefits the church year after year.

Agency Fund

Nonprofit organizations can establish an endowment to support future programming, financial stability, or strategic growth. These funds also give supporters a trusted way to contribute long-term.

Ways to Give

We offer many giving options to meet your financial situation and philanthropic goals. No matter your stage of life, there’s a giving method that’s right for you.

Click below to read about each of your options.

• Cash Gifts

The simplest and most direct way to give. Donate via check, credit card, or in person at our historic office inside the Stengel-True Mansion. Fully deductible up to 50% of your adjusted gross income.

• Stocks & Securities

Gifts of appreciated stocks or bonds offer valuable tax benefits: avoid capital gains and receive a deduction for the full market value. Long-term appreciated stocks and even poorly performing stock make great charitable gifts. We’ll work with your advisor to make it simple.

• IRA Distributions

If you’re 72 or older, you can direct Required Minimum Distributions (RMDs) from your IRA to us. These Qualified Charitable Distributions reduce your taxable income—ideal for donors who don’t itemize.

• Life Income Plans

Create a legacy and receive income for life.

- Charitable Remainder Trusts allow you to donate assets now while receiving ongoing income.

- Charitable Lead Trusts provide income to the Foundation first, then return assets to your heirs.

- Charitable Gift Annuities offer fixed lifetime income and leave the remainder to support your fund.

We offer free custom calculations to help you explore these options.

• Wills & Bequests

You can name Marion Community Foundation in your will or trust. Whether it’s a fixed amount or a percentage, you can use retirement plans, life insurance, or other assets to create your lasting legacy.

Assets such as retirement & pension plans and life Insurance policies also make great charitable gifts in a tax-savvy manner for your heirs.

• Memorial Gifts

Honor a loved one or celebrate a milestone by creating a memorial or tribute fund. Contributions can also be made to existing funds for this purpose. Visit our memorial gifts page to learn more.

• Real Estate & Agricultural Gifts

Gifts of land, homes, or even grain and livestock can support your charitable goals and provide significant tax benefits, as can gifts of cryptocurrency. We’re experienced in handling these unique gifts.

• Fundraising

Want to raise money to support or grow a fund? From 5Ks to spaghetti dinners, we’ll support you through the legal and financial steps to ensure your event is a success.

Download our gudie to Donor-Initiated Fundraising (PDF)

Call us at 740-387-9704.

Visit us weekdays, 9am–5pm at 504 S. State St. in Marion, Ohio.

Together, we’ll build a legacy of generosity that lives on forever.

Learn more: Donate Now | Memorial Gifts | Give to a Fund