3 Reasons to Give Away Appreciated Stock

You know your way around the stock market. You make wise investment choices and enjoy the benefits of excellent returns. And, maybe you invested in a stock that skyrocketed and now your portfolio is out of balance. If you have a heart for nonprofits, we have some good news: donating stock directly to charity, such as Marion Community Foundation, is one of the most tax-efficient ways to give. Here are three reasons why:

Double your tax benefit

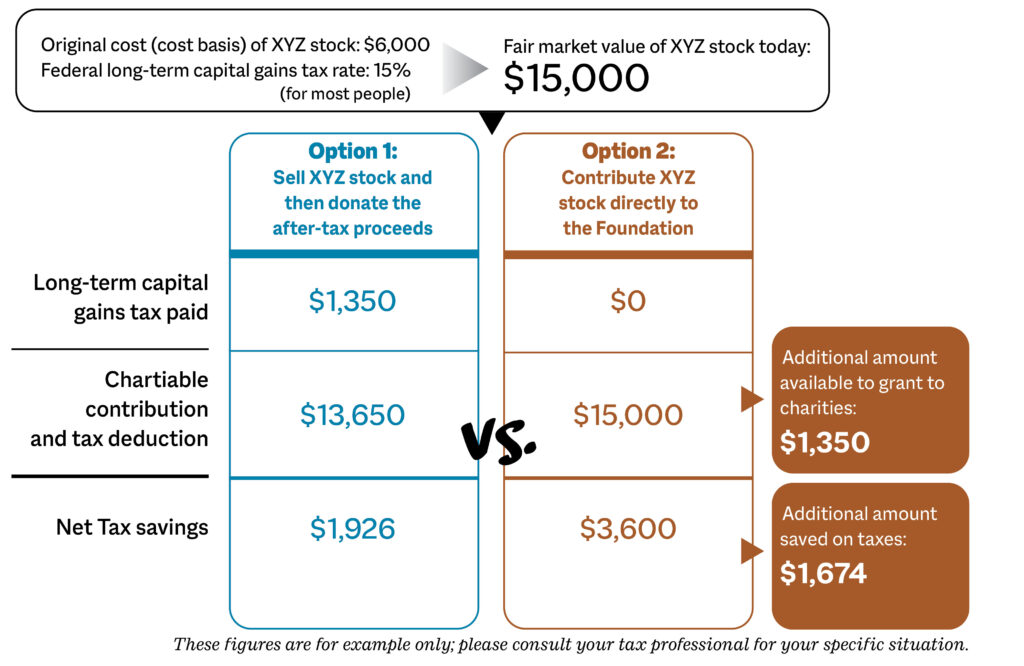

When you donate stock directly to a charity, you receive a deduction off your income for the amount (fair market value) donated, the same way you would receive a deduction by making a cash donation. In addition, a donation of appreciated stock that has been held one year or more avoids capital gains tax. This could increase the size of your donation by up to 20 percent.

Potential to avoid future capital gains

You may have a favorite stock that you would like to hold for a very long time. Strong performance in that stock may increase your desire to hold the stock; but, the higher the stock goes, the larger your potential tax burden becomes. Consider donating a portion of the appreciated stock and then purchasing new shares with cash. This resets your cost basis and reduces your future capital gains.

Keep your portfolio balanced

If one of your portfolio positions has increased more than the others, choosing to donate some of that security can help it from becoming a concentrated position that adds risk to your investments. Utilizing a donation plan can put your capital gains to work and keep your portfolio in check. The chart below shows the tax savings of donating $15,000 of an appreciated security that has been held for one year or more versus selling an appreciated security, then donating cash. This assumes the security was originally purchased for $6,000 and is now worth $15,000.

Don’t worry. You can still take advantage of this tax-saving strategy by using appreciated stock to create a Donor Advised Fund. This will allow you to realize the tax savings and remain actively involved in how those funds are donated in the future.

If your donations, along with other allowable deductions, don’t put you over the standard deduction—for 2024, $14,600 for single filers;/$29,200 for married filing jointly—ask us about a savvy strategy known as ‘bunching’ a Donor Advised Fund. As always, your professional advisor can help you decide what strategies are right for you and how they fit into your complete financial plan.

Investment Confidence

Expertise & Trust

Jeff Touched So Many Hearts

New Funds: Adler, Dixon, President’s Band Club

Generosity in Many Forms

Giving in Circles

Want to Stop Writing Checks?

IRAs Are a Charitable Idea

A Passion for Animals

2024-25 Board of Directors: Members & Officers