Attorneys. Financial Planners. Funeral Directors. Accountants.

This TOOLKIT is designed for use by you, as a professional advisor, and provides detailed information on Marion Community Foundation – how to establish charitable endowment funds, our investment and spending policies, and other aspects of the Foundation’s operations. It is intended as a guide for professional advisors seeking to inform their clients on planned giving options available through Marion Community Foundation.

Our Profile Book is a comprehensive overview of all that Marion Community Foundation offers. Download a copy by clicking here or printed copies are available upon request by emailing our Community Relations Manager, loristevenson@marioncommunityfoundation.org. Or, if you just need a quick overview, try our Basic Info Flier.

Quick Facts

about Marion Community Foundation

- Established in 1998

- More than 500 named funds addressing quality of life issues in Marion

- $65 million in assets working for Marion’s benefit

- Awarding more than $2.5 million in scholarships and grants annually

- 15-member Board of Directors

- A 501(c)(3) tax-exempt nonprofit philanthropic institution

Professional Advisors’ Toolkit

We understand your primary objective, as a professional advisor, is to find effective financial solutions for your clients. One of ours is to give them to you. We can help you advise clients who want to make a difference in the Marion community. We can help you guide their generosity to the next level – one that supports local charities they care about in a permanent way and establishes their legacy in the community they call home.

Marion Community Foundation offers several types of named endowment funds to meet your clients’ philanthropic goals, provide tax advantages, lifetime income opportunities, and other planned giving options. We make it easy for someone to be generous.

Contact us at info@marioncommunityfoundation.org or call 740-387-9704.

TOOLKIT TOPICS

Endowment Giving | Types of Funds | Creating a Charitable Plan | Ways to Give | Transitioning a Private Foundation | Services & Policies | Advisor FAQ | Financials | Especially For Funeral Directors

“It is highly recommended that you and your client work with Marion Community Foundation during the estate planning process in order to create the charitable intent before signing a will or trust.”

Endowment Giving

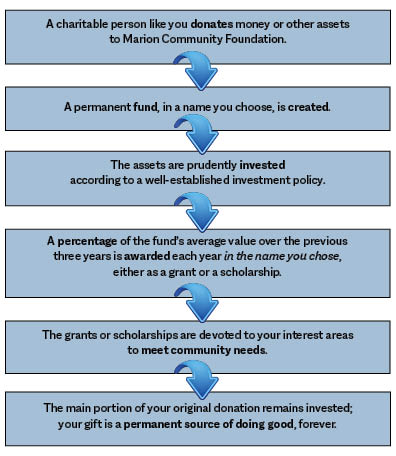

An endowment is a fund created and named by an individual (or couple or family) to support a local charity or cause. Endowed funds created at Marion Community Foundation will enable your client to support a charity or cause which is important to them in a permanent way. It is a way to ensure that gifts to a charity or cause will be made in their name – or the name of a loved one – every year, forever, and to tie their name to the community they love in a significant and lasting way.

Endowment giving is a major, planned charitable gift that comes from a donor’s financial or estate planning. It is often used to honor or memorialize an individual or recognize a family. Gifts could come from appreciated securities or stock, real estate, a retirement plan, or even cash – but they are generally made from outside of discretionary income. Some donors are in a position to make the gift (or multiple gifts) during their lifetime, but many make the gift as a beneficiary designation in their estate. Planned gifts can offer many benefits to the donor, including tax benefits or the potential for returned income.

Non-Endowed is also an Option

Some clients may prefer not to create a permanent fund. This option is available for both scholarships and grant funds. With this type of fund, donors could give a one-time gift and direct that scholarships be awarded annually until the fund is depleted. Or, they could decide to contribute a specific amount each year and direct that it be paid in the current year for scholarships or grants. This is what is known as a “pass-through.” A third choice is to blend an endowed fund with some non-endowed gifts. This might be a good option for those who want to start awarding scholarships or grants immediately, but currently don’t have the ability to contribute at the fully endowed level. In this scenario, your client could annually contribute to both the principal and a pass-thru amount in order to make annual awards while building their fund’s principal to the endowed level.

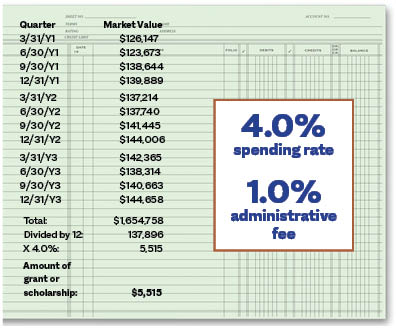

Awarding Grants & Scholarships

Grants and scholarships are awarded from the charitable endowment funds at Marion Community Foundation when the principal reaches a minimum balance. For most fund types, that is $12,500; for scholarships, the minimum is $25,000. In accordance with our Spending Policy, the amount of a grant or scholarship for each year is determined by multiplying our spending rate times an average market value of the fund over the previous 12 calendar-year quarters. We use an average in order to help reduce some of the market fluctuations that can affect the value of a fund at any given time.

Resources for Your Client (Downloadable PDFs)

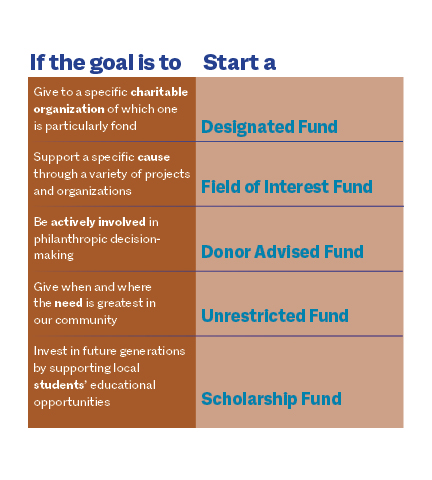

Types of Charitable Endowment Funds

Marion Community Foundation offers several types of charitable endowment funds, each with specific attributes which may appeal to your client and address their charitable giving goals. Clients can start a charitable endowment fund now or in the future, through a number of planned giving options available through the Foundation.

Designated Funds support a specific or “designated” charity or nonprofit.

Field of Interest Funds support broad, general causes, such as education, animal welfare, community development, etc.

Donor Advised Funds allow the donor to recommend grants from their fund to the charities of their choosing.

Unrestricted Funds support community needs as they arise and at the direction of Marion Community Foundation’s Board of Directors.

Scholarship Funds support the education of students meeting defined selection criteria.

Agency Funds, also known as organizational endowments, are also available at Marion Community Foundation. This type of fund can be created by nonprofit organizations to provide funding for their own operations and programs.

Creating a Charitable Plan

Decide WHEN to Give. Your clients can create a fund now, provide for it in their will, or create a trust arrangement that benefits their family as well as charity. It’s important, however, to include the Foundation’s president near the beginning of the planning discussions in order to make the client’s charitable plan efficient and workable. We can assist you with the necessary fund documents that will make your job easier and your client’s goals achieveable, even if the client is not yet ready to make a monetary gift at this time.

Decide WHAT to Give. Almost any kind of asset can be used to start a charitable endowment fund – cash, publicly traded securities, closely held stock, real estate, life insurance, retirement accounts, cryptocurrency, and tangible personal property.

Choose the NAME of the Fund. Most of the charitable funds at Marion Community Foundation are named for the donor, the donor’s family, or to honor or memorialize someone special. We will help your client with this naming process.

Choose a TYPE of Fund. A variety of funds are available to flexibly meet your client’s charitable interests. See the previous section on Types of Funds.

We welcome the opportunity to work with you and your client. We can meet with you in person or virtually to:

- Consider giving goals and charitable intent

- Review the various types of charitable funds available and determine which best fits the client’s purpose

- Draw up the governing document that formalizes the giving intentions

- As part of the governing document (if allowed by the type of fund being created), designate fund advisors and successor advisors

- Establish a name for the fund, which could be the client’s name, a family member’s, a cause, or one that will keep the donor anonymous

- Make an establishing gift using one or more of the various contribution options available

Effective Ways to Give

We accept a wide variety of assets and, while we are happy to accept cash and checks, the use of other assets for charitable giving may be more consistent with a donor’s objectives.

Assets other than cash and marketable securities require approval from our Executive Committee as required under our Gift Acceptance Policy.

Wills & Trusts

The most common form of planned giving is a charitable bequest in a will or trust. This can be a specific amount, a percentage of the estate, or even the residual balance of the estate after all other bequests have been made.

Retirement Funds

Perhaps the most tax advantageous bequest, and in some ways the simplest, is for your client to name Marion Community Foundation as the beneficiary of their retirement income — IRA, 401(K) or 403(b) – or estate plan – TOD or POD. As a public charity, Marion Community Foundation can receive 100 percent of the value of the retirement assets and it will be tax-free.

IRA Gifts

Thanks to the PATH Act of 2015, donors age 70-1/2 or older can have their annual required minimum distributions (RMD) from a traditional IRA sent directly to Marion Community Foundation. Although these direct IRA distribution gifts are not tax deductible, by having them donated directly to the Foundation, the amount will not be counted as income.

Stock Gifts

Giving stock provides a double tax break—no capital gains tax on the appreciation and a deduction for the entire gift. Gifting low basis stock(s) will provide your client with the most benefit.

Using stock that has decreased in value is also a good way to make a charitable gift. Your client can claim the capital loss on their tax return and get a tax deduction for the cash gift.

Life Insurance

If your client has a life insurance policy they no longer need, the policy can be gifted to charity. By naming Marion Community Foundation as the owner and beneficiary of the policy, the donor will receive a charitable deduction for the cash value or the adjusted basis. The value of the policy will be used to create a charitable endowment fund according to the donor’s wishes.

Real Estate Gifts

Like appreciated stock, appreciated real estate avoids the capital gains tax and provides a charitable deduction for the full fair market value of the real estate. Cryptocurrency is treated similarly to stock or real estate for tax purposes — providing both a tax deduction and the benefit of no capital gains.

Life Income Gifts

There are sophisticated financial vehicles such as Charitable Remainder Trusts, Charitable Lead Trusts, and Charitable Gift Annuities which allow individuals to transfer assets to Marion Community Foundation while continuing to receive income from those assets. This type of gift is a good fit for people who hold assets that would make beautiful gifts at some time in the future, but currently need those assets for income. Life income gifts such as these can increase income for life, give a generous charitable contribution for the year of the gift, and, if the gift is stock, avoid capital gains taxes.

Automatic Recurring Giving Donors can give regularly to build a fund or spread out annual giving — without having to remember to write checks — with automatic, recurring giving. Click HERE to download the authorization form. Donors can choose the amount, the frequency, and the fund to which to give — which will be automatically transferred from their bank account via EFT to the endowment fund(s) chosen.

Resources for Your Client (Downloadable PDFs)

Transitioning a Private Foundation to a Community Foundation

It is not uncommon for individuals or families or even companies who have established a private foundation to become overwhelmed with the responsibilities and costs associated. One solution for your client is to transfer the assets to Marion Community Foundation.

If you have a client interested in starting a private foundation, both you and your client may find it easier to start a charitable fund at Marion Community Foundation instead. We do all the work to establish the fund, including taxes and reporting, at no cost to you or your client.

Section 507 of the Internal Revenue Code allows for the termination of a private foundation by the transfer of its assets to one or more public charities, each of which must have been in existence for at least five years. Marion Community Foundation satisfies both of those requirements. The private foundation assets can be used to create a charitable endowment fund or add to an existing one.

Resources for Your Client (Downloadable PDFs)

Services & Policies

Our approach to fund management is multi-level and includes:

Chief Investment Officer

Marion Community Foundation retains independent contractors such as Clearstead Advisors to provide the services of Chief Investment Officer on an outsourced basis. Clearstead is an independent institutional and wealth advisory firm which specializes in financial advising for nonprofit endowments.

Local investment Managers

The Foundation’s portfolio is diversified and investment responsibility is spread among six local investment managers — firms and people you and your clients know. These firms are overseen by our CIO, Investment Committee, and Board of Directors and include: Stifel, Alluvial Private Wealth, 3D Private Wealth Advisors, Whetstone Financial, Lehman Capital Management Group, and EdwardJones.

Investment Committee

The Investment Committee is a 9-member subsidiary group to our Board of Directors. Presently, this includes:

Megan Queen, Chair | A former chair and member of our Board of Directors; Vice President/Senior Insurance Analyst for the Irrevocable Life Insurance Trust Asset Review Team at J.P. Morgan Chase & Co.

Hon. Matthew Frericks | Board member and judge for Marion County Court of Common Pleas

Dr. Charlie Garvin | A past chair and former member of our Board; an ophthalmic surgeon and physician executive at OhioHealth Marion Area Physicians

Dr. Justin Hamper | Non-board member; North Region Director of Pharmacy with OhioHealth

Scott Knowles | CEO and General Counsel of Sims Brothers Recycling and Board member since 2017

Dr. Ryan McCall | Member of the Board of Directors since 2018 and president of Marion Technical College

Kevin Smith | Board member and retired Regional President of The First Citizens National Bank

Dr. Chuck Speelman | Superintendent of Tri-Rivers Career Center & Center for Adult Education and Board member since 2016

John Colla, CIO | Outsourced Chief Investment Officer from Clearstead Advisors

Investment Policy

Marion Community Foundation’s stewardship of its funds addresses both sides of the equation—both a prudent investment policy and a prudent spending policy—which protect the sustainability of our funds. We utilize an institutional investing strategy, as opposed to the retail investing model most individuals use. Community foundations invest in a manner that produces steady returns annually in order to support the community programs and causes for which the Foundation was created. Such a diversified, conservative strategy will not produce especially high returns in bull markets; conversely, it also will not produce drastically low returns in bear markets. The goal—and the challenge—is to produce returns which sustain annual spending requirements for the Foundation’s mission, while preserving the long-term value of the donors’ original gifts.

Asset Allocation

Our investment strategy includes a diversity of investments. Click here to view our most recent, quarterly asset allocation chart.

Spending Policy & Fees

Since 2017, Marion Community Foundation has utilized a prudent program spending rate of 4.0% for our funds, maintained a graduated spending rate reduction strategy to safeguard the long-term value of the funds when market conditions and other factors negatively impact a fund, and set administrative fee rates to 1.0% for all fund types. Administrative fees are deducted from the fund’s value – your client pays NO fees to Marion Community Foundation.

Administrative Services

Once a fund is created, we provide comprehensive administrative services, including:

investing | correspondence | annual reporting

| promotion | selection committee(s)

auditing | bookkeeping |

following all state and federal laws & regulations

follow-up with organizations & colleges

Advisor FAQs

If my client establishes a fund at Marion Community Foundation, can I continue to manage their assets?

For new funds in excess of $500,000, the fundholder may recommend a particular investment manager for their fund. Our Chief Investment Officer and Investment Committee will then review the investment process utilized by the recommended financial manager and the investment policy for the relevant fund(s) and will ultimately make the determination of whether or not the manager will be engaged. Ask us about our Investment Advisor Acceptance and Approval Policy.

Charitable endowment funds may be established at Marion Community Foundation with as little as $100 and a plan to fully endow the fund at a future time. To begin making awards, a fund must have a principal of $12,500 to begin generating grants and $25,000 to begin awarding scholarships.

May grants be made to organizations outside of Marion County?

Marion Community Foundation is able to grant to any 501(c)(3) charitable organization. Community foundations, by their very nature, are locally-focused; most donors choose to have their gifts benefit communities in Marion County (Ohio).

How can my clients access information about their charitable endowment fund(s) at Marion Community Foundation?

Marion Community Foundation is transparent about its operations, that’s part of what earned it National Standards accreditation from the Council on Foundations. Our donors can see the details of fund activity on our website’s Donor Dashboard, a user-friendly, online portal. Donor Dashboard allows donors 24/7 access to their fund(s) with the ability to:

- View account balance(s), contribution and grant history, monthly statements

- Download reports

- Review grants by organization name or field of interest

- Add to their fund

How do your services differ from those provided through a commercial charitable fund provider?

Marion Community Foundation does much more than provide the check-writing services of a gift fund at a brokerage. A few ways Marion Community Foundation supports charitable giving efforts include:

- Works with donors to identify causes that are important to them, then connect them with the organizations in our community that are making a difference.

- Develops personal relationships with donors, helping them create a giving strategy to achieve greater charitable impact and offering a level of flexibility that often does not exist at larger organizations.

- Utilizes local financial firms as advisors to our portfolio of endowment funds. We work with financial professionals you already know and who know and value the Marion community.

- Keep our fingers on the pulse of the community to help donors know the needs in our community and how well local agencies are addressing these needs.

Click here to download a flier detailing the benefits of a community foundation.

What charitable fund types are available through Marion Community Foundation?

Marion Community Foundation offers several types of charitable endowment funds, each with a specific focus and intent. In working with donors, we help match a donor’s intentions with the type of fund that best achieves their philanthropic goals. The fund types available include:

- Scholarship funds

- Donor Advised funds

- Unrestricted funds

- Designated funds

- Field of Interest funds

- Agency funds

Click here to learn more about the types of funds offered by Marion Community Foundation.

What are the advantages of creating a charitable endowment fund at Marion Community Foundation over a private foundation?

A fund with Marion Community Foundation offers the advantages of a private foundation without most of the expense and hassle. As a public charity, we offer donors the maximum charitable tax deductions available, without the limitations imposed on charitable contributions to private foundations. And, we handle all of the details – like investing, tax reporting, bookkeeping, auditing, payment of awards, and following applicable state and federal laws and regulations.

Click here to download a flier detailing the benefits of a community foundation.

Financials

We are Marion Community Foundation, Inc. and our EIN is 31-4446189.

Need something else? Please contact Julie Prettyman at julieprettyman@MarionCommunityFoundation.org or 740-387-9704 to schedule a meeting or to find out how we can help you and your clients.

Especially For Funeral Directors

Memorial funds are one of the most common categories of endowments established at Marion Community Foundation. Funds can be created to support a loved ones’ favorite charity that they gave to regularly or a scholarship to support students at their alma mater. We even have options for recognizing loved ones without creating an entirely new fund. We understand that emotions run high when facing the loss of a loved one and have created a flier for families which simplifies the fund creation process and provides the appropriate language for the obituary to encourage memorial contributions.

For Memorial Gifts

The obituary and notice at the funeral home should read as follows:

Memorial contributions may be made to Marion Community Foundation, 504 South State Street, Marion, OH 43302, for the purpose of establishing a charitable fund in memory of {name of deceased}.

OR

to benefit the (name of existing) Fund.

Community’s Memorial Scholarship Fund

The Community’s Memorial Scholarship Fund assists local scholars achieve their goals of higher education. It was created to memorialize a number of individuals collectively. All of the persons memorialized are recognized during Marion Community Foundation’s annual Scholarship Program. The fund awards scholarships to graduates and seniors from any Marion County high school who rank in the upper 50 percent of their class.

Forever Remembered Charitable Fund

The Forever Remembered Charitable Fund awards grants each year during the Community Grants Program. These grants help the hard working local nonprofits and charities and their mission to serve the people of Marion. Our Forever Remembered Charitable Fund is an unrestricted fund which provides flexibility and discretion to award grants wherever the Foundation’s Board of Directors determine our community’s needs are the greatest. Awards can be made on an as-needed basis and address unforeseen and pressing needs in the Marion area as they arise.

Those wishing to honor a loved one can do so by contributing any amount to the Forever Remembered Fund and honorees will be recognized, by name, for the year in which gifts are made.

Resources for Your Client (Downloadable PDFs)